With the help of the payment system PayPal, sending and receiving money online is safe and secure. It enables you to use PayPal to make online purchases from participating stores by connecting your bank account, credit card, or debit card to your PayPal account. Your payment information is kept secure by PayPal, which acts as a go-between for your bank and retailers. Other apps can integrate with PayPal. One such integration that can enhance the advantages of e-commerce is the PayPal Salesforce Integration.

Salesforce is a top supplier of business apps available in the cloud across various platforms. Platforms like Salesforce CRM, customer 360, digital 360, and other tools are available on it.

Introduction to PayPal

Customers can utilize PayPal as a digital payment option when making purchases online. Thanks to PayPal, which retains payment information, customers don’t have to enter their credit card or bank account numbers every time they make a purchase. PayPal also conceals this payment information from businesses, enhancing online buying security. Payments can be integrated into an online checkout process for small and large enterprises.

If you use PayPal, you can:

- Move funds between your PayPal account and your bank account.

- Use your credit card to obtain a cash advance, then deposit the funds into your PayPal account.

- Pay people directly by transferring funds from your PayPal account to theirs.

- Send you a cheque for the remaining balance on your PayPal account.

- Obtain a PayPal debit card to use your PayPal account to make offline transactions.

Salesforce Integration with PayPal

This part covers the PayPal Salesforce integration now that you’ve had a quick introduction to Salesforce and PayPal.

Method 1: PayPal and Salesforce integration

Salesforce and PayPal cartridges may work together without any issues. With the aid of this PayPal Salesforce Integration, businesses in the e-commerce sector can double their sales while cutting expenditures.

Among the most often used APIs are:

- PayPal and PayPal Credit components provide support for PayPal Express Checkout from Cart.

- From the Payment page, use PayPal Express Checkout.

- IPN (Instant-Payment-Notification) (Instant-Payment-Notification)

- In-Context Checkout, PayPal One Touch, and several independent API calls made the sales funnel simpler.

- PayPal Website Payments Pro with automatic Salesforce transaction posting

Online transactions can be automatically logged on the cloud platform with the help of PayPal Salesforce Integration. You may create new possibilities directly from PayPal sales and integrate them with Salesforce contacts thanks to our reliable integrating service.

1. Use the PayPal Immediate Payment Notification (Real-time data integration)

We can use PayPal’s IPN (immediate payment notification) service and integrate PayPal with Salesforce directly using a bespoke Salesforce REST API and a Salesforce website. PayPal configuration adjustments are required to set up a Salesforce API connection.

2. Use the PayPal REST API to import data into SF:

Depending on how frequently the client wishes to sync such transactions, we will design and construct a new Salesforce Apex batch class to PULL all the transactions made at the customer’s PayPal account at a set interval. Creating a batch class in Salesforce to fetch the transaction and authorize the associated app for PayPal at predetermined intervals. Create a class that is schedulable for managing Cron jobs. Writing unique Apex code for the administration of Refresh tokens.

Method 2: Using Chargent, PayPal and Salesforce are integrated.

1. Chargent installation and configuration

- Integrate Chargent Transactions and Base into your Salesforce org.

- Set up Chargent by the Quick Start Guide’s detailed instructions.

- If the Remote Site Options in Salesforce aren’t currently enabled, you might need to do so for Chargent versions older than 5.57 for PayPal Payflow Pro to start the PayPal Salesforce Connection.

- Choose Settings by clicking the gear symbol in the top right corner.

- Choose Remote Site Settings under Security.

- Search for PayflowProAPI, then select Modify.

- Active should be checked.

- Press “Save”

- Same with PayflowProTestAPI.

2. Integrating PayPal Payflow Pro with Salesforce to Use PayPal Payflow Pro

- In Salesforce, select the app launcher by clicking on it.

- Search for Gateways by selecting it from the Search for Apps or Things box.

- Choose Payflow Pro (PayPal) as the Gateway Type by clicking New.

- When using Chargent, connect the following fields to your Payflow Pro login information:

Merchant Login = Chargent Merchant Reference (from Payflow Pro)

Password = Chargent Merchant Security Key (from Payflow Pro)

Chargent Merchant Reference = Partner ID from Payflow Pro (for the production account, if you joined up through a Bank rather than directly with PayPal, it might be different from “PayPal” for the test account).

- Configure the following Gateway fields.

To activate the Gateway, check the Active box.

Utilize tokenization if you’re going to use Payflow tokenization.

Choose the types of cards you will accept from the available ones (based on your gateway settings and what card types they can process – Visa, Mastercard, American Express, etc..)

If you want to utilize tokens longer than 12 months, check the PayFlow User Recurring Profiles checkbox in the Chargent Gateway record.

What forms of payment do you accept? Just credit cards or ACH? (also known as electronic check, e-check, or direct debit)

Available Currencies: Which currencies do you accept? This depends on your payment gateway and the currencies that it supports.

Data handling for bank and credit card accounts tells Chargent when to delete information from Salesforce. You have four choices.

Never Simple

Clear Following a Succeeding Charge

Following each transaction, clear

When a Token Is Present, It Clearly

The following should also be configured if Payment Requests or Payment Console are used.

- Types of PR Transactions That Are Accessible

Charge Entire Amount – Instantly charges the credit card.

Authorize Full Amount – This choice keeps the money on hand until the card is charged. It does not charge the card.

Approve Minimal Amount: This option will only hold the bare minimum that your Gateway will permit without charging the card. To record the transaction, you must charge the exact amount.

3. After integrating PayPal with Salesforce, configure your PayPal fraud settings.

PayPal employs the same security as their normal accounts, even if you have set up a test account to deliver an experience as near to the real world as feasible. So, if you submit test transactions and get an error saying “Under Review by Fraud Service,” you may need to alter your fraud settings.

- Activate Test Setup under Service Settings > Fraud Prevention. Alter Default Filters

- To test, alter the parameters as needed, then select “Deploy.”

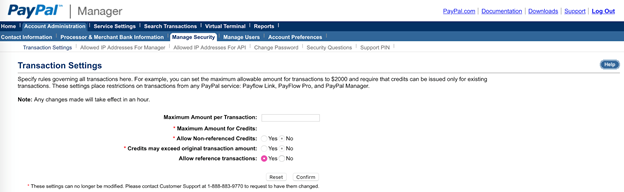

- Go to Account Administration > Transaction Settings to set a maximum transaction amount.

Note: You might also need to allow your IP address to test.

- Click on Service Settings.

- Fraud Defense

- controlling standard filter lists

- Edit

- Put the IP address there.

- Press “Add”

- Press “Save”

4. Payflow Pro from PayPal and Salesforce Integration Credit Card Testing

- To perform a test transaction, create a new Chargent Order record and fill it with sample data.

- Customer Name

- Charge Amount ($0-$1000 is advised; amounts greater than $2001 will not pass the test)

- Check the Manual Charge checkbox.

- Billing Specifications

Initial Billing Name

Billing Last Name

Billing Address

Billing City

State / Province of Billing

Postal or Zip Code for Billing

Billing Country

Contact Email for Billing (optional but allows a receipt to be sent on approved transactions).

Credit Card Number

- American Express 9782822246310005

- American Express 3744963539831

- American Express Corporation 378734493671000

- Diners Club 30569392059504

- Discover 6011111111111117

- Discover 6011000990139424

- JCB 3530111333300000

- JCB 3566002020360505

- MasterCard 2221000000000009.

- MasterCard 2223000048400011

- MasterCard number 2223016768739313

- MasterCard Number: 5555555555554444

- MasterCard #5105105105105100

- Visa 4111111111111111

- Visa 4012888888881881

- Visa 4222222222222

- Expiration Month Date

- Date of Expiry Year

- Any future expiration date in the format MM/YY is acceptable.

If there are multiple active gateway records in Chargent, the gateway field must be filled in. You must select which Gateway to utilize if there are two or more active gates.

- Press “Save”

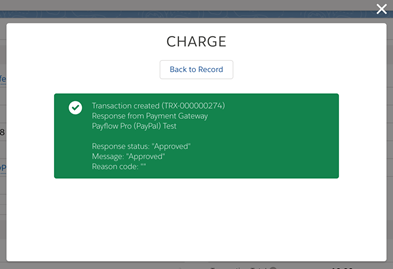

- Click the “Charge” button on the order record you created in Salesforce.

- Go to the CSC (Card Security Code). For American Express, this will be 4 digits, while it will be 3 digits for Visa, Mastercard, and Discover.

- A popup with the message “Approved” will appear.

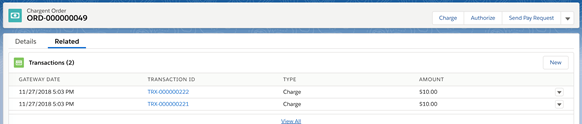

The Salesforce page will refresh once you click the Back to Record button on the popup dialogue box, and you can then click on Related to view the Transactions with the date, type, and transaction amount.

The Test Endpoint checkbox on the Gateway record allows users to choose between sending to the payment gateway’s live and test environments when Chargent is installed in a production or developer Salesforce org.

As a last step in testing, you can transmit real transactions from a Salesforce Sandbox by using Chargent’s Endpoint Override field on the Gateway record and entering the production endpoint of the Gateway you’ve selected there.

The production endpoint URL for Charge’s PayFlow Pro integration is as follows:

- https://payflowpro.paypal.com

Remember that the domain must be present in the Remote Site Settings and that the whole endpoint URL must be specified in the Endpoint Override field.

6. PayPal Salesforce Integration Tokenization

Other payment gateway interfaces in Chargent operate differently from tokenization using the Salesforce PayPal Integration Payflow Pro gateway. Recurring Billing Profile IDs and Reference Transaction tokens are both used by Payflow Pro.

Reference Transaction tokens, essentially the previous transaction ID that may be used to submit a new transaction, have a 12-month expiration date. Sensitive cardholder data is not supplied; PayFlow Pro from PayPal Salesforce Integration retrieves all essential payment data from past transactions using the Token.

Recurring Payment Profiles in PayPal Integration in Salesforce never expire. While it doesn’t support the Authorization transaction type, generally speaking, it is a more dependable approach to executing recurring charges against the user’s payment information.

The Reference Transaction token will still be utilized to submit Authorization transactions even if Recurring Payment Profiles are enabled in the PayPal Salesforce Integration.

- The Chargent Token field equals PayPal Reference Transaction.

- Customer Token field in Chargent = Recurring Profile ID in PayPal

7. To configure the Paypal Salesforce Integration’s reference transactions and tokenization:

Reference Transactions are, by default, deactivated in PayPal Management.

- To activate them, go to Account Management > Transaction Settings.

For Salesforce

- Tick the “Use Tokenization” box in the Chargent Gateway record you created for Payflow Pro.

- In the Chargent, select the PayFlow Use Recurring Profiles checkbox. You must use a gateway record to utilize tokens for longer than a year.

- Establish the Credit Card Handling field.

- Never Mistake: Chargent won’t automatically delete any card information.

- Clear After Successful Charge: After a successful charge, the charge will only remove the card’s security code, expiration date, and credit card number.

- Following every transaction, the credit card’s security code, expiration date, and other details are cleared (Charge, Void, Refund)

- The credit card number, expiration date, and card security code will only be cleared when a token is shown in the token field.

Your first successful charge will result in deleting the Credit Card Number field value and storing a token for further charges. The Reference Transaction will be kept in the Token field following a successful transaction. The Customer Token field will be used to store PayPal’s Profile ID.

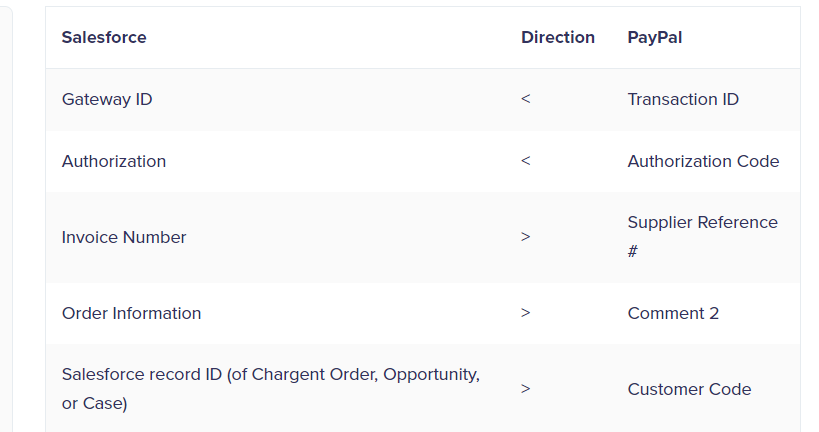

8. Field Mapping for Paypal Salesforce Integration

Below are a few relevant fields and their mappings between the Paypal Salesforce Integration and Chargent software.

Conclusion

This article provided a detailed overview of PayPal to Salesforce Integration. A step-by-step tutorial for the PayPal Salesforce Integration was also provided.

Although using Salesforce and PayPal Integration is useful, setting up the right environment is difficult. AwsQuality enters the picture to make things simpler. AwsQuality Data is a No-code Data Pipeline that offers amazing 100+ pre-built Integrations.